Miner Weekly: ERCOT Hits Reset on Texas’ AI and Mining Power Queue

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

If it wasn’t already obvious, ERCOT’s message this week was pretty blunt: the way Texas has been approving massive new power users no longer works.

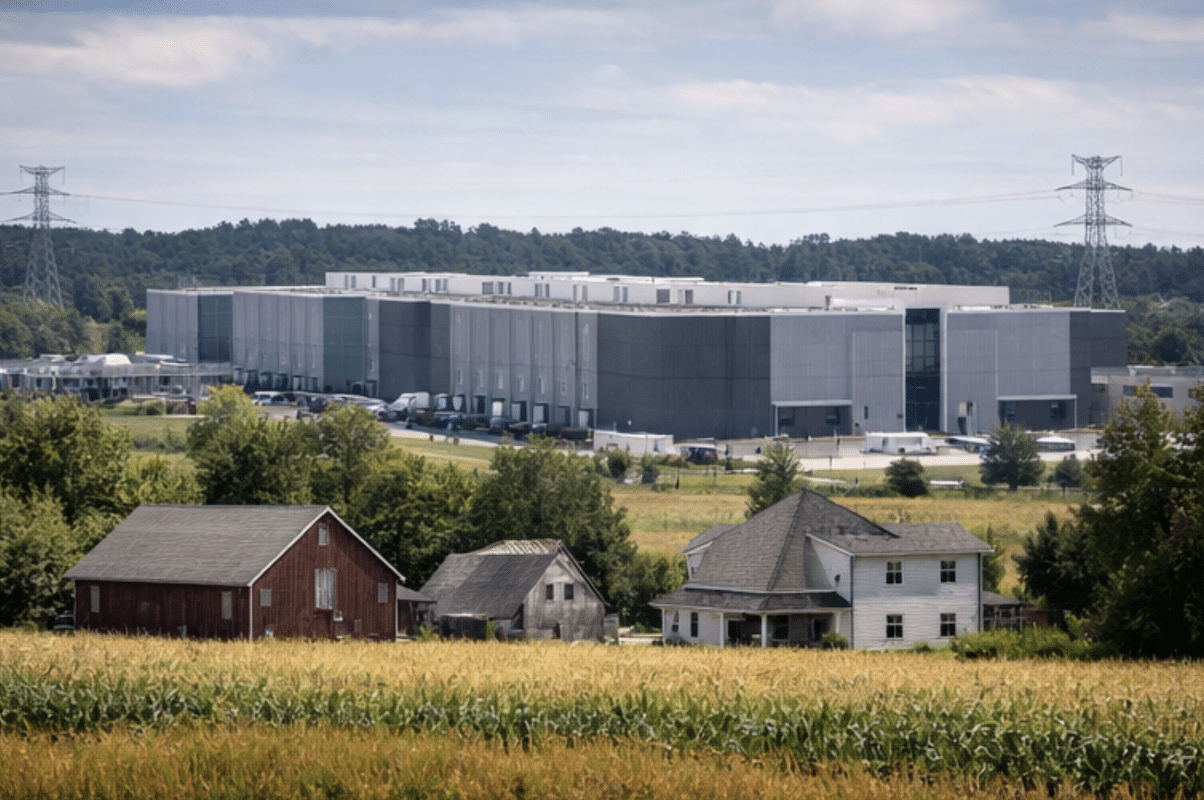

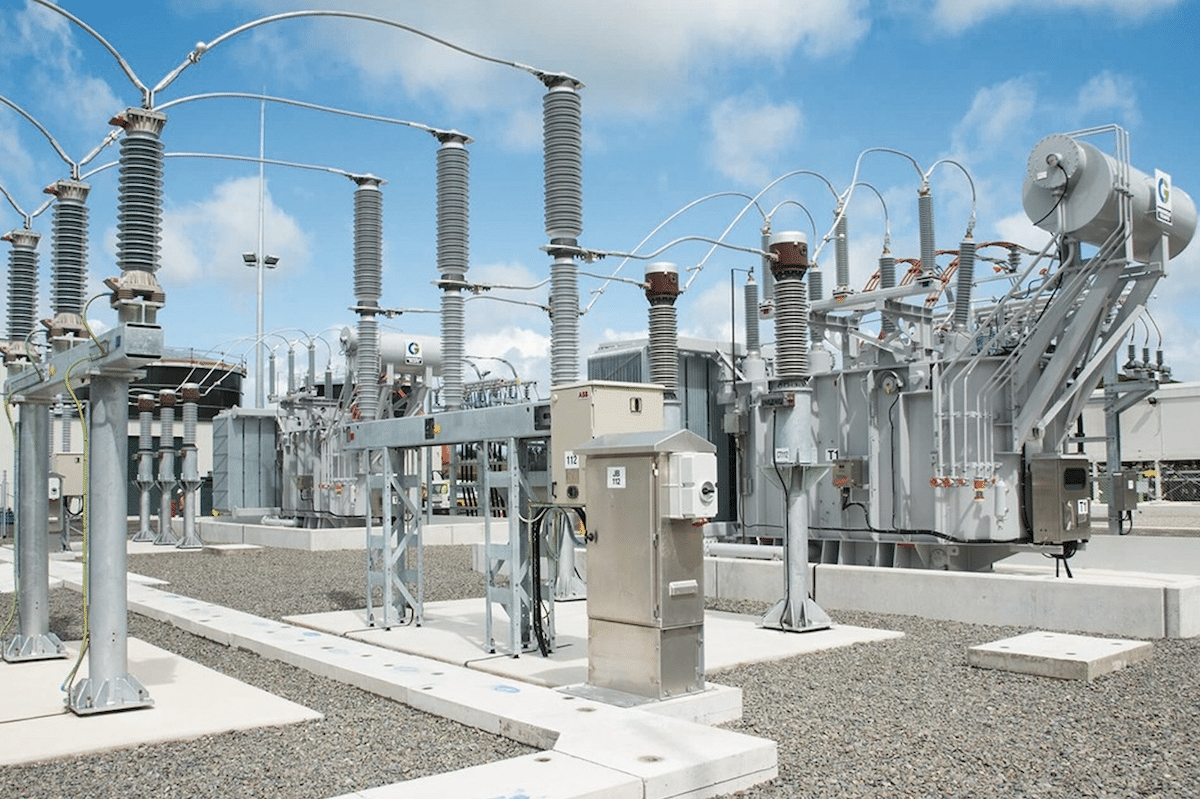

At a Feb. 3 workshop that drew more than 700 participants, the Texas grid operator rolled out a draft plan to overhaul how large loads — think AI data centers, Bitcoin miners, and other hyperscale compute — connect to the Texas grid. The backdrop is a staggering backlog: more than 250 gigawatts of large-load requests, roughly three times ERCOT’s current peak demand.

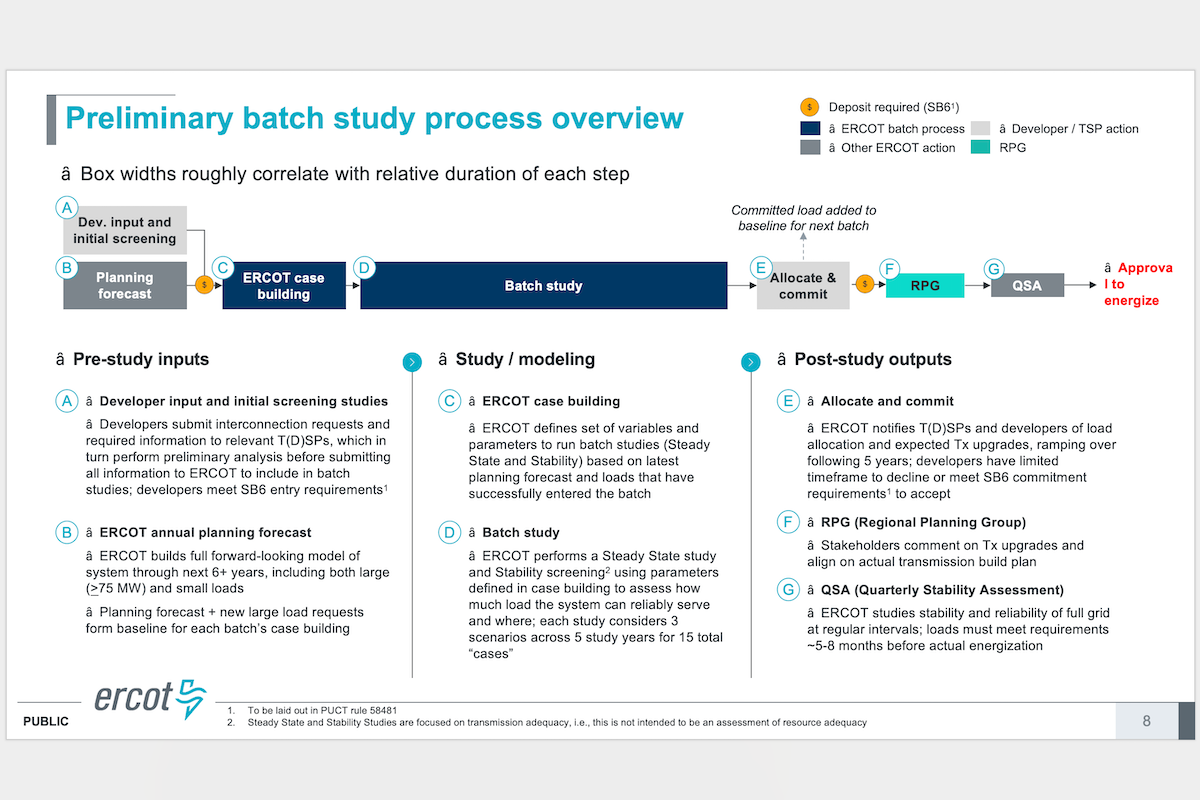

For years, large loads have been studied one at a time by transmission providers. That model breaks down when hundreds of gigawatts pile up behind it. New projects change assumptions, old studies get invalidated, and developers get stuck in restudy hell. ERCOT officials made it clear they’re close to the point where they’d have to go back to projects that already “passed” and tell them those approvals might need to be reopened.

That’s what this proposal is trying to avoid.

The core idea is simple: stop studying projects in isolation and start studying them in batches. Under ERCOT’s plan, large loads would be grouped into system-wide batch studies run every six months. ERCOT would look at their combined impact, figure out what the grid can actually support, and then allocate power to each project — potentially less than requested, at least at first.

To kick things off, ERCOT is creating a transitional phase called “Batch Zero,” which is meant to deal with the most advanced projects already in the queue. Even here, though, not everyone gets a free pass. ERCOT said around 8.2 gigawatts of load could be subject to reassessment, depending on how far along projects really are and whether they meet new readiness and commitment standards tied to Senate Bill 6.

Jeff Billo, ERCOT’s vice president of interconnection and grid analysis, summed up the motivation pretty cleanly during the workshop. ERCOT wants to get to “one study to rule them all,” rather than constantly revisiting old assumptions as new requests flood in.

A big shift embedded in the proposal is ERCOT’s open embrace of partial and ramped service. Instead of promising full power on day one, ERCOT would tell projects how much load they can count on each year, with allocations increasing as transmission upgrades come online. ERCOT staff argued that most developers would rather have a clear, constrained answer than an open-ended maybe.

Not everyone was fully convinced. Meta’s energy program manager, Katie Bell, pointed out that some projects have been in the interconnection process for 18 months and still wouldn’t qualify for Batch Zero, raising concerns about even more delays. Others echoed worries about transparency — how allocation decisions are made, how assumptions change, and how developers are supposed to plan around them.

ERCOT acknowledged those concerns and said predictability is the main goal. Fixed timelines, explicit go/no-go decision points, and clearer communication are supposed to replace the current fog of restudies and shifting goalposts. The tradeoff is that not every project gets what it asked for, at least initially.

One area that drew noticeable interest was how ERCOT plans to treat flexible loads. Officials repeatedly referenced strong stakeholder support for recognizing controllable loads and co-located generation — concepts that matter a lot for Bitcoin miners and hybrid compute sites. The rules here aren’t fully baked yet, and ERCOT admitted much of this won’t be finalized until later in 2026, but the direction is clear: flexibility is starting to count for something.

ERCOT plans to hold another workshop and then take the proposal to state regulators later this month. Until the Public Utility Commission signs off, the existing interconnection process stays in place.

For miners, the subtext of the workshop was hard to miss. In Texas, access to power is becoming less about who showed up first and more about who’s real, who’s flexible, and who can live with ramping instead of instant scale. That’s a big shift — and one that could end up favoring loads that already know how to dance with the grid.

Regulation News

- British Columbia Opens 400MW Power Competition for AI Data Center Projects – TheMinerMag

- Texas Approves 7.65 GW Air Permit for Pacifico Energy’s AI Power Campus – TheMinerMag

- Pennsylvania Approves 15 On-Site Gas Generators Backing AI Data Center in Clearfield – TheMinerMag

Hardware and Infrastructure News

- Bitcoin miners get an open-source alternative as Tether launches MiningOS – CoinDesk

- Terawulf Adds 1.5 GW to AI Power Portfolio With Kentucky, Maryland Site Acquisitions – TheMinerMag

- Western Kentucky Aluminum Plant Sold for Redevelopment into Data Center – WDRB

- Bitcoin Hashprice Hits Record Low as BTC Falls Below $70,000 – TheMinerMag

Corporate News

- BitRiver Insolvency Looms as Bitcoin Miner Founder Placed Under House Arrest – TheMinerMag

- Cango Breaks Bitcoin HODL Stance, Sells 550 BTC Amid Mining Pressure – TheMinerMag

Financial News

- Cipher Seeks $2B in New Secured Notes to Fund AI Data Center Build in Texas – TheMinerMag

- Cipher Bond Tied to AWS Data Centers Gets $13 Billion of Orders – Bloomberg