From Exahash to Gigawatt: How 2025 Redefined Bitcoin Mining – Miner Weekly

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

As 2025 came to a close, the stories that dominated bitcoin mining over the past 12 months point to an industry that quietly but decisively crossed a structural threshold. The year was not defined by a single capitulation event or regulatory shock, but by a steady re-ranking of what actually matters in mining—and who still benefits from it.

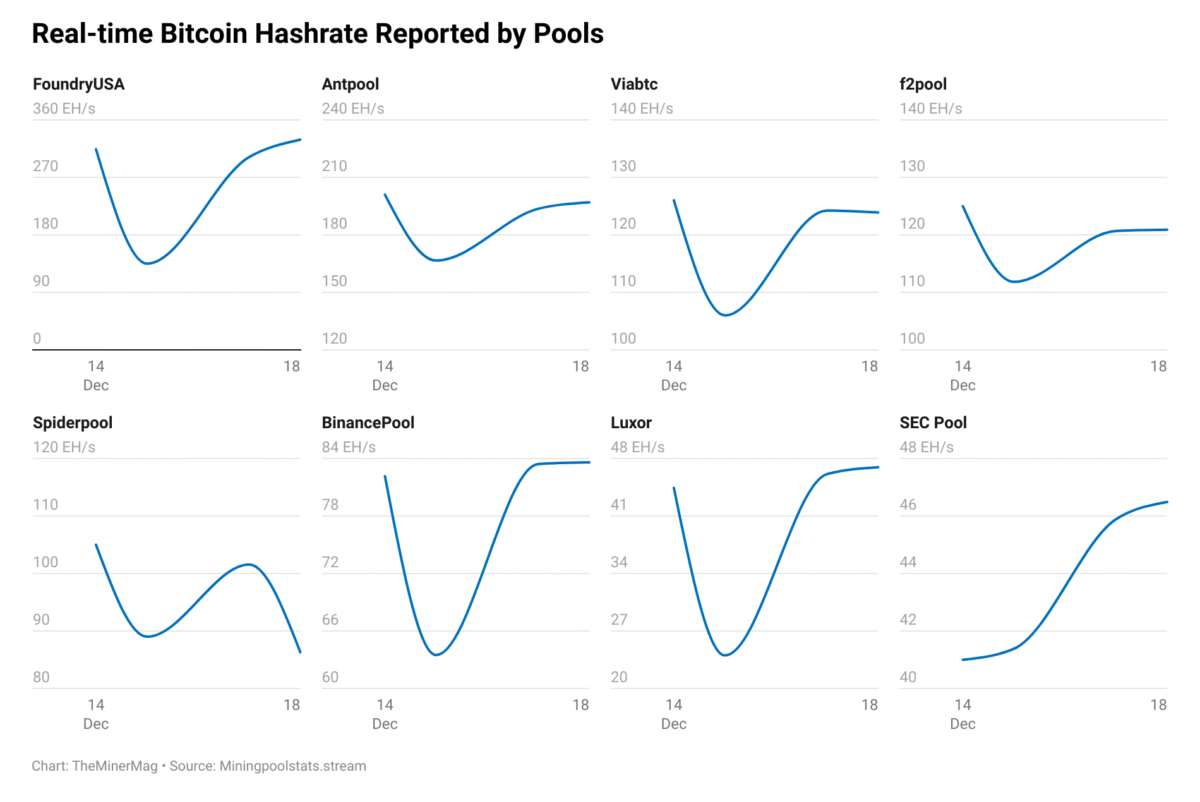

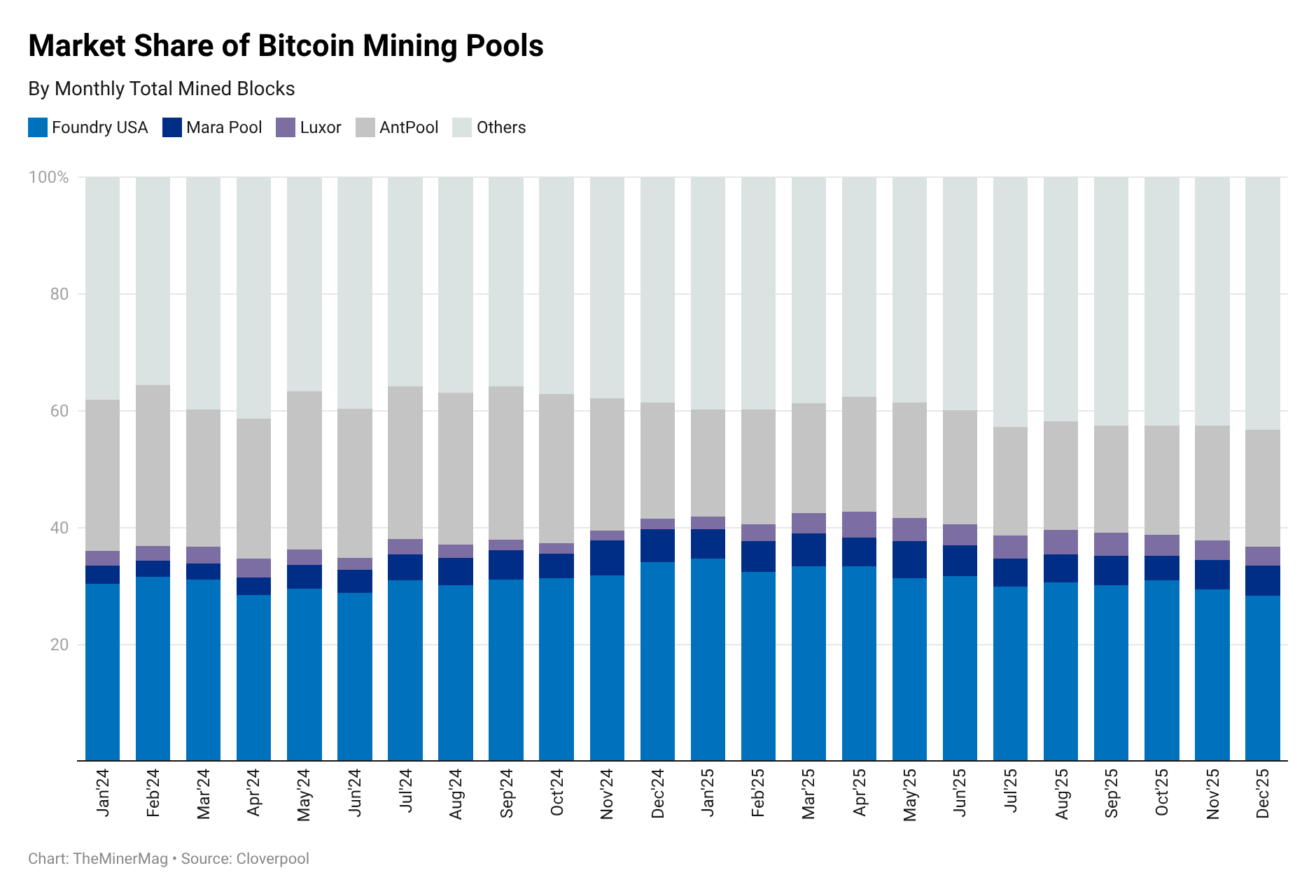

The headline number still looks impressive on paper. The network’s monthly average hashrate grew by roughly 34%, rising from 778 EH/s in December 2024 to about 1,048 EH/s by December 2025. Yet beneath that growth sits a more telling shift. North American pools steadily lost ground in terms of block share. At the start of the year, Foundry USA, MARA Pool and Luxor together mined more than 40% of all bitcoin blocks. By December, their combined share had slipped to around 35%, despite continued hashrate additions across the globe.

That divergence—rising hashrate, falling block share—captures the defining narrative of 2025: bitcoin mining is no longer the singular focus for many of the industry’s largest players. For some, mining became one leg of a broader infrastructure strategy. For others, it became a legacy business gradually giving way to AI and HPC data centers, or, in a few cases, something to exit altogether.

Price action offered little relief. Bitcoin did set new all-time highs in October, briefly trading above $125,000. But the relentless growth in network hashrate absorbed most of the upside. By year-end, as prices retraced, hashprice fell to historically low levels below $40/PH/s. Even during a bull year for bitcoin, mining economics failed to meaningfully improve.

On the hardware front, the technology story continued to advance. Bitmain, MicroBT, Canaan, Bitdeer and Auradine all pushed new machines into the low-teens joules-per-terahash range. Yet efficiency gains ran headfirst into collapsing revenue per unit of compute. The result was a sharp shift in market dynamics: for the first time in a bull cycle, the ASIC market tilted decisively in favor of buyers. Public miners began phasing out S19-series machines early in the year, and as the hashprice squeeze intensified, that replacement cycle only accelerated. By year-end, even Bitmain was cutting ASIC prices, signaling that manufacturers may need to focus more on the secondary and replacement market than on pure growth demand.

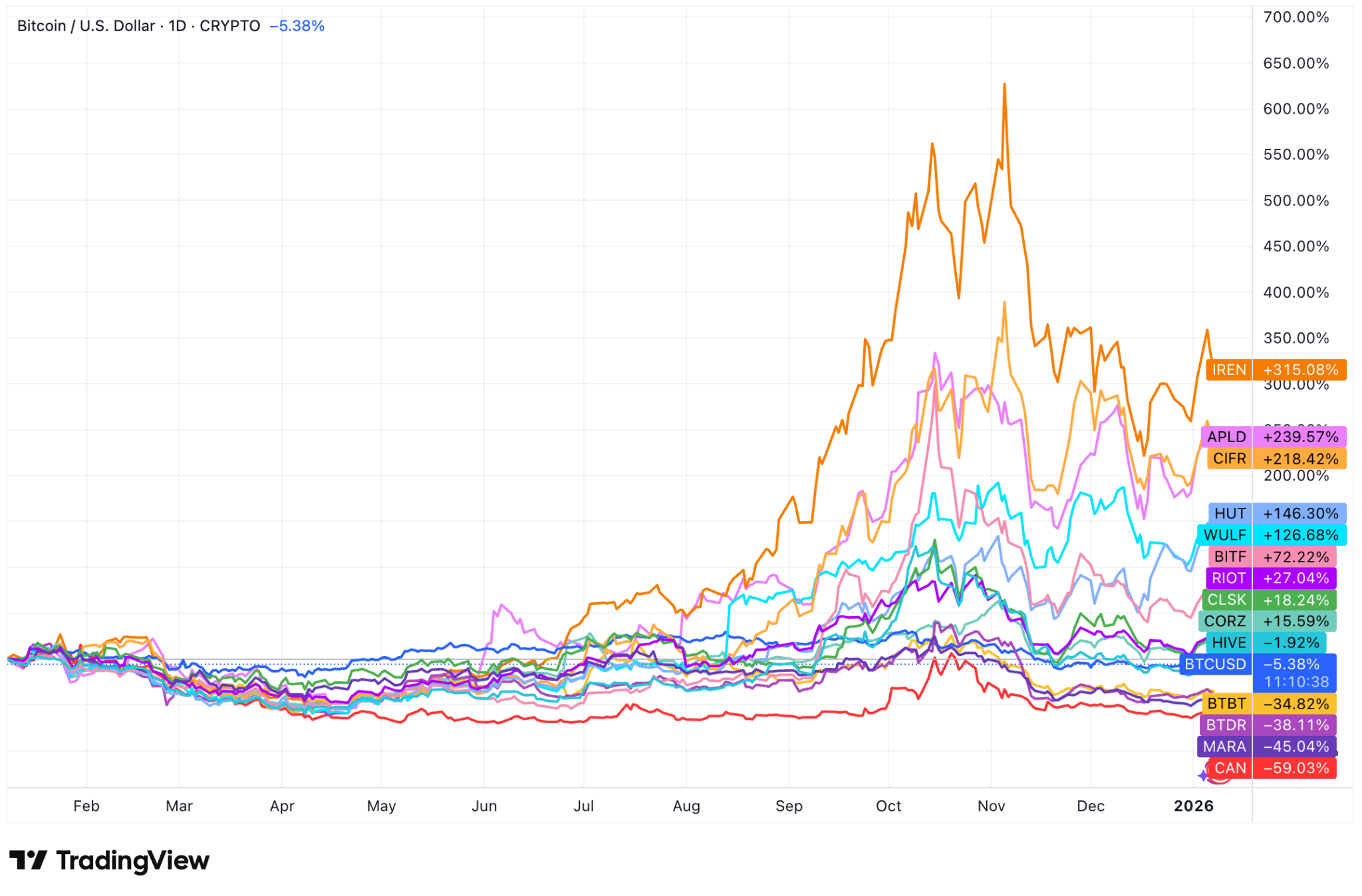

Investor behavior reinforced the pivot. 2025 will be remembered as the year mining equities decoupled from bitcoin production narratives and re-rated around AI and data center exposure. The strongest stock performers—IREN, Cipher, Applied Digital, Hut 8 and Terawulf—were all tied to major HPC colocation or cloud servicing announcements. Even long-time bitcoin-only operators began repositioning, emphasizing power capacity, land and grid access over incremental exahash growth.

The financing backdrop also looked very different from prior cycles. Mining debt reached new highs in 2025, but the structure had changed. Instead of high-interest, equipment-backed loans like those seen in 2021, much of the capital came via zero- or near-zero-coupon convertible bonds. The proceeds were largely earmarked for data center buildouts and power infrastructure, not additional bitcoin miners.

That evolution leads to a broader conclusion. In 2021, hashrate was the hardest asset in the system. In 2025, and likely beyond, energy became the real currency. Bitcoin miners, by virtue of their power expertise and grid positioning, simply happened to arrive early.

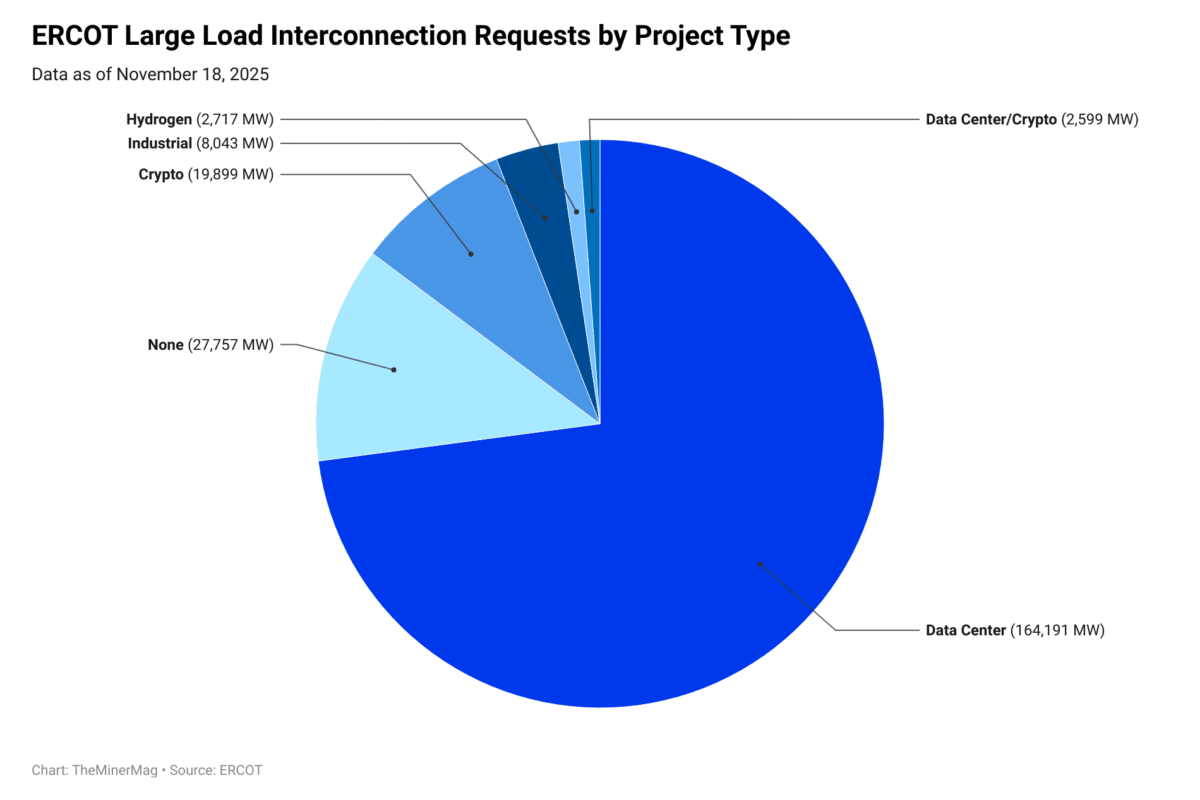

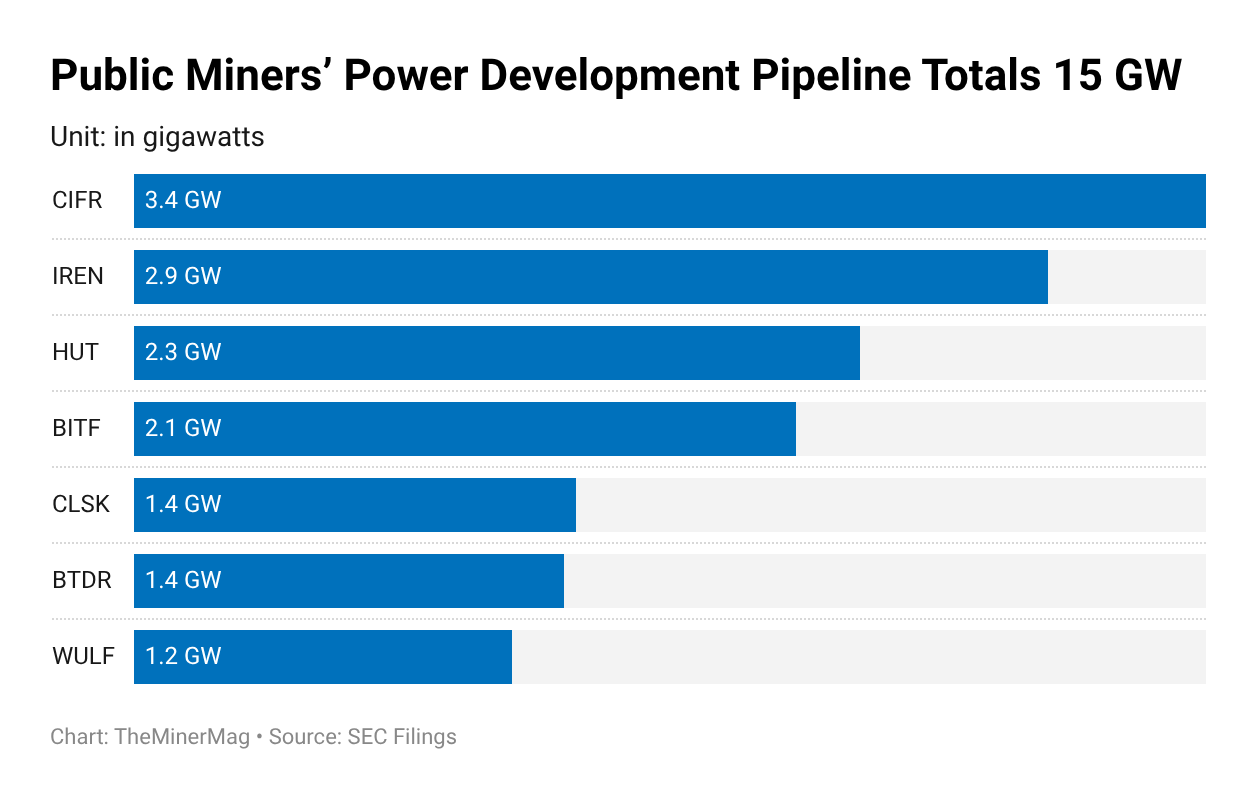

Across seven major public miners, announced power capacity in development now totals roughly 15 gigawatts, a pipeline that increasingly overlaps with prospective AI and HPC data center demand. Much of this capacity is still early-stage—interconnection studies, land control, or preliminary agreements—and there is no guarantee it ultimately reaches full energization. But the sheer scale of the pipeline highlights what has replaced exahash growth as the industry’s preferred signaling mechanism. That dynamic extends beyond miner press releases. ERCOT has received an unprecedented wave of large-load interconnection requests over the past year, driven primarily by data centers rather than bitcoin mining alone.

This shift also helps explain a quieter but symbolically important change: the retreat from monthly disclosures. Public miners once used monthly production and hashrate updates as a way to showcase dominance and growth. In an HPC-first world, those metrics matter far less. For many large operators, there are fewer bitcoin mining muscles left to flex.

Taken together, 2025 was not the year bitcoin mining collapsed. It was the year mining stopped being the center of gravity.

Hardware and Infrastructure News

- Goldman Helps Lead Financing for 5-Gigawatt Texas AI Power Sites – Bloomberg

- Bitfarms Exits LatAm With Paraguay Sale as Bitcoin Miner Deepens Shift to HPC, AI – TheMinerMag

Corporate News

- Riot Revamps Executive Pay as CFO Transition and Data Center Incentives Take Shape – TheMinerMag

- Cipher Appoints Lee Bratcher, Drew Armstrong to Lead Policy and HPC Strategy – TheMinerMag

- Canaan’s new initiative plans to help grow tomatoes with heat from Bitcoin mining – The Block

- Riot’s December Bitcoin Sales Mark Largest Monthly Liquidation as Hashprice Sinks – TheMinerMag

- Calgary company eyes power generation for bitcoin mining as stranded oil and gas well solution – The Globe and Mail

Financial News

- Riot Resets ATM With New $500M Raise as Bitcoin Mining Cash Flow Remains Thin – TheMinerMag

- Hut 8 Expands Bitcoin-Backed Credit Facility With Coinbase to $200M – TheMinerMag

- Vistra to Add 5.5 GW of Gas Capacity in $4B Cogentrix Deal as AI Load Rises – TheMinerMag

Feature

- Meta Acquisition Puts Spotlight on ManusAI Founder’s Early Bitcoin Roots – TheMinerMag