Miner Weekly: A New Era of Mining Capitulation in Bitcoin’s Bull Market

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

In previous market cycles, miner capitulation was a phenomenon reserved for the darkest days of the bear market—when margins were crushed and inefficient operators were forced offline. But this cycle is rewriting the script. Amid a robust bull market and bitcoin’s price hovering above $100,000, a different kind of capitulation is underway: one driven not by insolvency, but by strategic realignment.

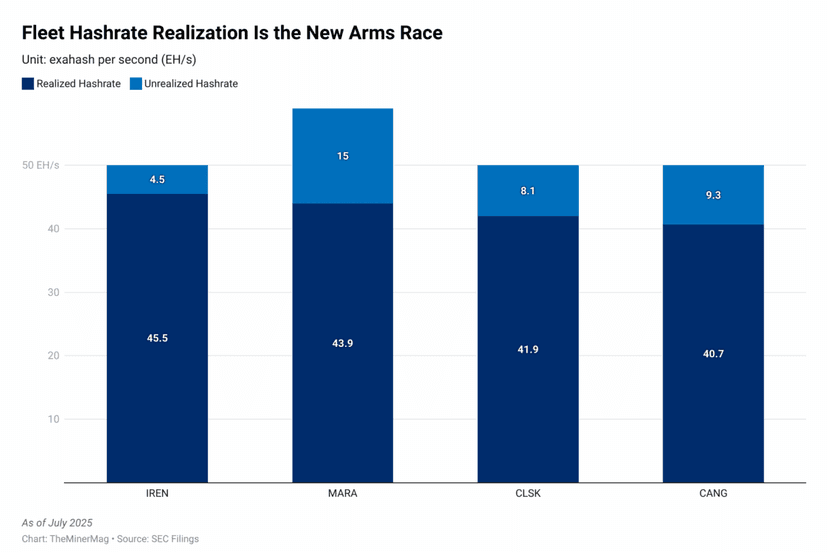

The most telling example came recently from Core Scientific. Once the largest public bitcoin miner, Core has signed a definitive agreement to be acquired by CoreWeave, the Wall Street-favored AI infrastructure player that began life as an Ethereum miner. With a realized hashrate of 12 EH/s, Core Scientific’s mining fleet is still formidable. But signs point to an eventual divestiture of its bitcoin mining business altogether, as CoreWeave eyes Core’s data center footprint to scale high-performance computing (HPC) workloads. This also raises questions about the fate of Core’s 15 EH/s preorder with Jack Dorsey’s Block.

Meanwhile, Bit Digital announced it would wind down its bitcoin mining segment due to the limitation imposed by its asset-light mining model and pivot entirely to an Ethereum-based treasury strategy. The company previously sold BTC for ETH in June 2024 and doubled down by raising $172 million in June 2025 to expand its ETH holdings. With BTC-to-ETH exchange rates now less than half of what they were during its first swap, the company’s move is both bold and revealing: a conscious retreat from the mining business amid what it sees as structurally challenged economics.

This moment signals a deeper shift in how investors view the mining sector.

From Leveraged Bitcoin Proxies to AI Infrastructure Plays

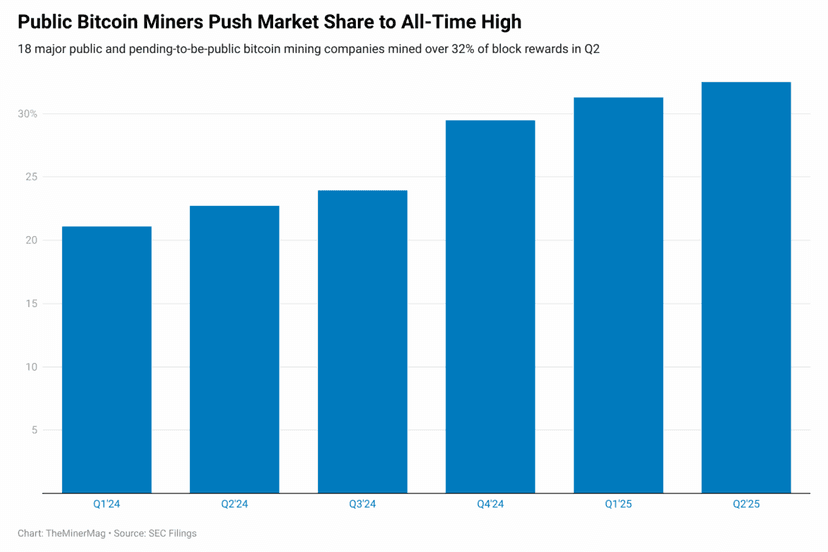

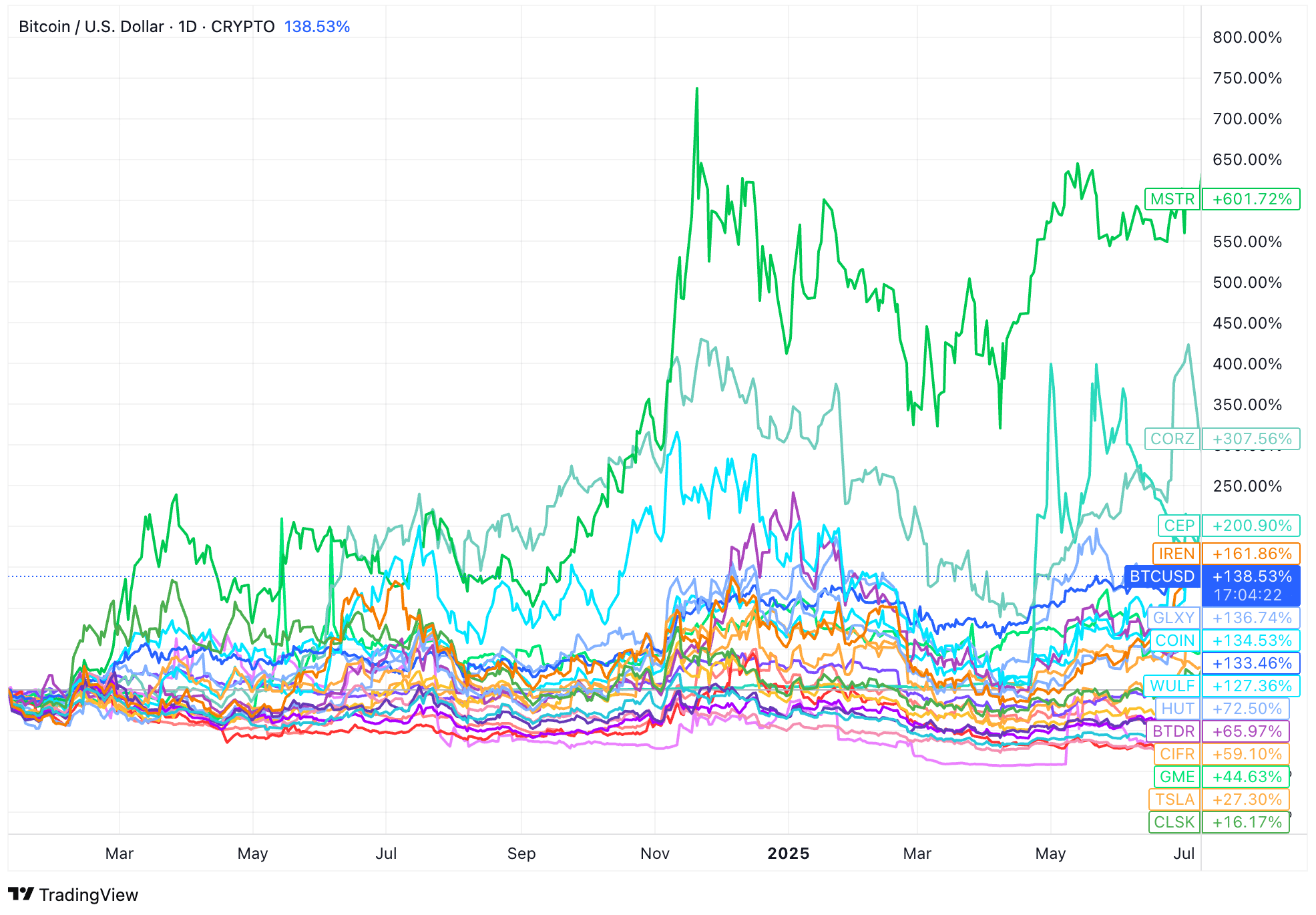

Bitcoin mining stocks once acted as high-beta exposure to BTC—amplifying its moves both up and down. But the arrival of spot bitcoin ETFs in January 2024 has flattened that leverage trade. Investors who once chased mining stocks for turbocharged gains can now access BTC exposure directly with institutional ease.

Since the ETFs’ launch, only two mining-adjacent stocks have outperformed bitcoin itself: Core Scientific (CORZ) and Iris Energy (IREN). Notably, these are not traditional bitcoin treasury vehicles. IREN sells all its mined BTC daily, and CORZ only began holding a small amount recently—under 1,000 BTC. Their outperformance stems not from BTC exposure, but from strategic pivots to AI and HPC, aligning with a broader investor appetite for compute infrastructure over commodity-style mining.

By contrast, most miners with large BTC treasuries have underperformed bitcoin post-ETF. The only consistent exception has been MicroStrategy (MSTR), whose aggressive laser focus on BTC accumulation continues to pay off. The divergence raises a compelling question: Can other mining firms – and also many other bitcoin treasury stocks – replicate MicroStrategy’s success by turning into bitcoin-holding entities? So far, the answer appears mixed—many are seeing short-term wins but still trail BTC over a longer horizon.

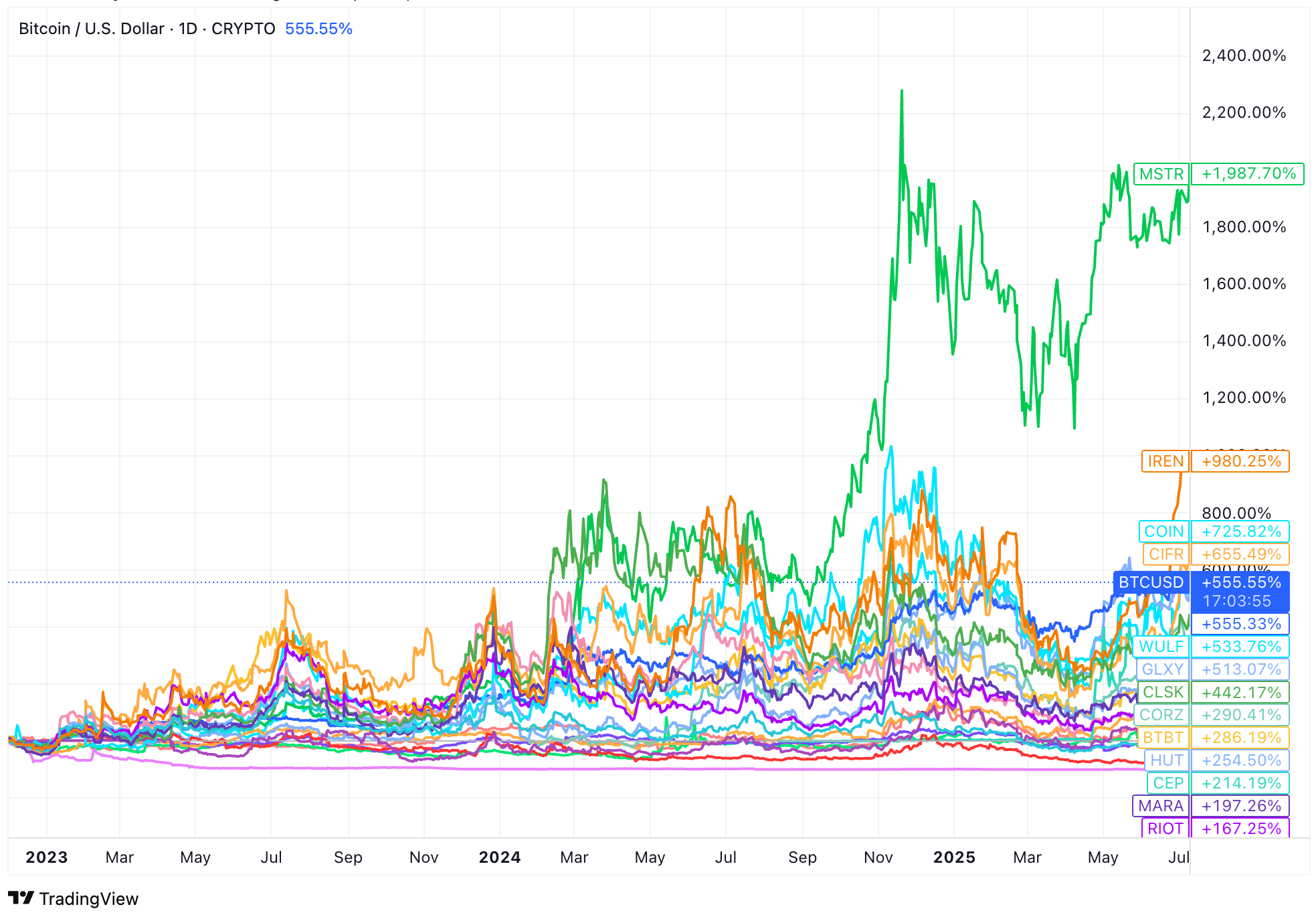

Even since the bottom of the last bear market in late 2022, only a handful of public miners—IREN, Cipher Mining (CIFR), and Terawulf (WULF)—have managed to outperform or match the performance of BTC. All others, despite having varied treasury or operational strategies, have lagged. The story they tell is not one of uniform failure, but of a rapidly changing competitive landscape where diversification and adaptability seem to matter more than raw exposure to bitcoin.

As hashprice pressures mount and AI infrastructure demand accelerates, the sector could be entering a new phase. Capitulation no longer means bankruptcy—it could mean reallocation. For public mining companies, the fork in the road is becoming clearer than ever: double down on bitcoin treasury or pivot to broader compute infrastructure (or both?) and try to outrun the cycle altogether. This isn’t just a new chapter in the bitcoin mining story. It might be a whole new genre.

Hardware and Infrastructure News

- Bitcoin Mining Difficulty Poised to Rebound as Hashrate Recovers to 900 EH/s – TheMinerMag

- BitFuFu Hits 36.2 EH/s Hashrate, 728 MW Capacity in June – CoinDesk

- CleanSpark Hits 16.15 J/TH in Efficiency as It Reaches 50 EH/s Milestone – CoinDesk

Corporate News

- Tether plans further Bitcoin mining expansion in South America with Adecoagro tie up – The Block

- Esports Giant Ninjas in Pyjamas Buys Bitcoin Miners, Expects Monthly Production of $6.5M in BTC – Decrypt

- CoreWeave to Acquire Core Scientific in All-Stock Deal to Expand AI Infrastructure – TheMinerMag

- CoreWeave’s All-Stock Bid for Core Scientific Likely to Draw Shareholder Scrutiny: KBW – CoinDesk

- Bit Digital Goes All-In on Ethereum, Converts Bitcoin and Equity Proceeds into ETH Holdings – TheMinerMag

Financial News

- CORZ, HUT, IREN Among BTC Miners Shedding Recent Gains After CRWV Deal – CoinDesk

- BIT Mining Shares Surge 150% in Premarket on Solana Treasury Plan – TheMinerMag