Miner Weekly: Bitcoin Hashrate Slides Sparks Misconceptions – Again

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

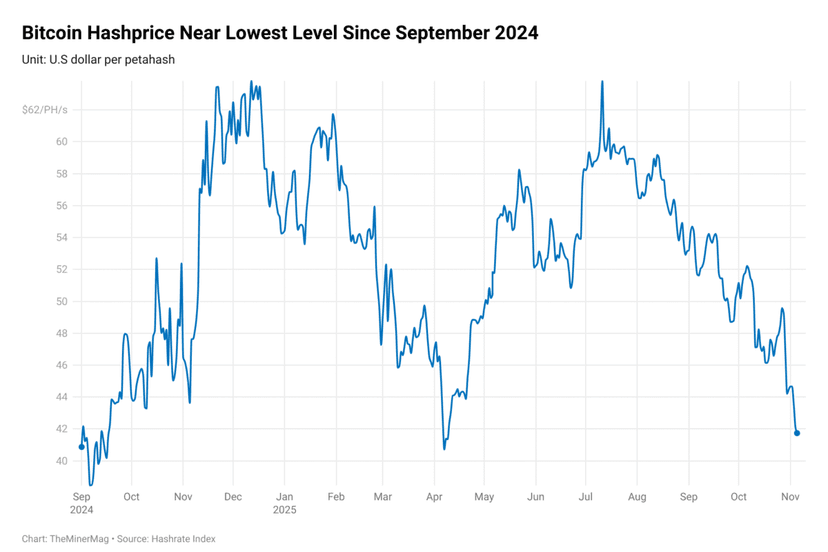

After reaching an all-time high of nearly 950 EH/s earlier this month, bitcoin’s seven-day moving average hashrate has slipped to around 810 EH/s—a notable 15% pullback. The decline has sparked widespread speculation online, with some attributing the drop to geopolitical tensions following the U.S. strike on Iranian nuclear facilities.

Posts circulating on X claim that the attack coincided with the hashrate dip and suggest it may have taken Iranian miners offline, removing “secret hashrate” from the network. Others are reviving perennial fears of a “hashrate crash,” pointing to the one-day average hashrate briefly dipping to 600 EH/s.

Many of these interpretations misunderstand how Bitcoin’s hashrate is actually estimated—an error that recurs as reliably as the network’s halving cycle.

Bitcoin’s hashrate is derived from mining difficulty and block production intervals, which means short-term figures can swing wildly due to randomness. The one-day hashrate metric is particularly volatile and often reflects statistical noise—essentially, how “lucky” miners get—rather than any fundamental shift in network capacity. By the same logic, it would be misleading to claim that Bitcoin’s hashrate has surpassed 1 zettahash based solely on a one-day spike.

For those interested in the technical details:

Hashrate (hashes per second) = Difficulty × 2³² / Average block interval (in seconds)

In this equation, the numerator remains constant throughout a given difficulty epoch, so fluctuations in estimated hashrate are entirely driven by variations in block production time.

Each market cycle brings a wave of newcomers who misread these fluctuations. The “hashrate crash” narrative resurfaces whenever metrics decline sharply, despite the probabilistic nature of block production in Bitcoin mining.

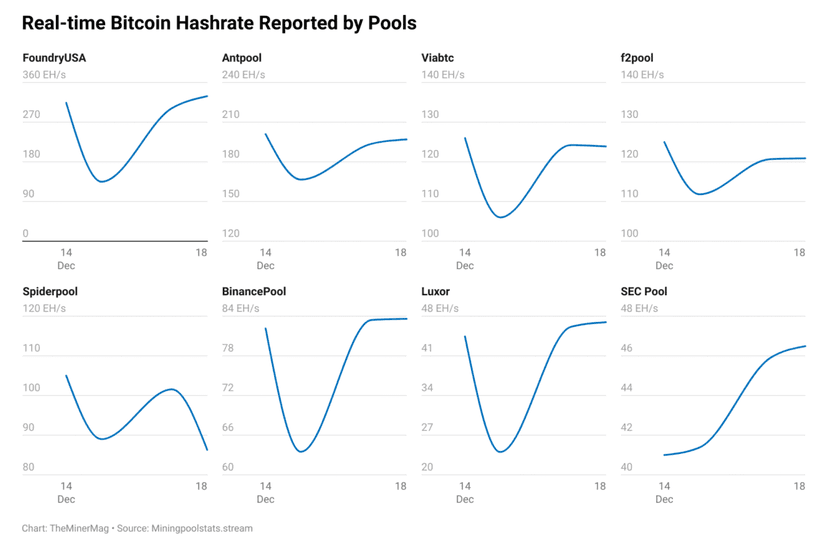

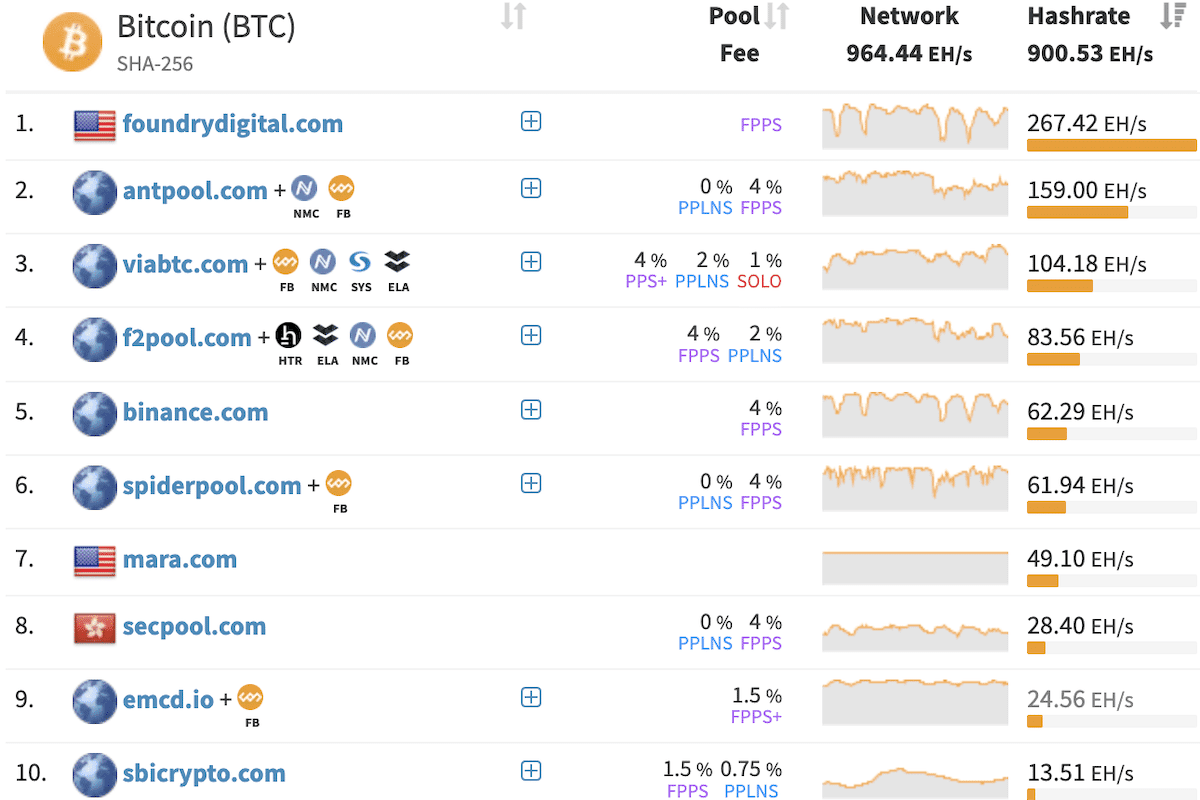

A more grounded explanation points to seasonal curtailment in North America as the likely cause. Pool-level data (see screenshot above) shows that the steepest drop came from Foundry USA Pool, which intermittently went offline before rebounding. This pattern is consistent with summer grid management in the U.S., where miners curtail operations during peak electricity demand to help stabilize the grid.

Even if some Iranian capacity was disrupted, the impact appears marginal compared to the widespread curtailments affecting major U.S.-based pools. It’s also unlikely that significant Iranian hashrate would be routed through Foundry USA, a U.S.-based pool subject to sanctions compliance.

Looking ahead, bitcoin’s next difficulty adjustment is expected around June 29 and could mark the steepest downward retarget since the aftermath of China’s 2021 mining ban—potentially steeper than the -7.32% drop seen during the 2022 bear market’s miner capitulation.

That said, the network hashrate appears to be recovering. The projected difficulty adjustment, which was estimated at nearly -10% a few days ago, is now expected to be slightly under -8%.

Regardless of the final figure, the anticipated difficulty drop should offer some temporary relief—especially for miners operating at the margin amid post-halving economics and summer curtailments.

Regulation News

- Norway plans temporary ban on power-intensive cryptocurrency mining – Reuters

Hardware and Infrastructure News

- HIVE Surpasses 11 EH/s on Track to Reach 25 EH/s by U.S Thanksgiving – Link

- MARA Taps Auradine for Half of 2025 Bitcoin Mining Rig Orders – TheMinerMag

- HIVE Acquires 7.2MW Toronto Data Center to Expand AI Infrastructure – TheMinerMag

- Cipher Mining Begins Bitcoin Production at 300 MW Black Pearl Data Center – CoinDesk

- Genesis Buys US-Made Auradine Bitcoin Miners Amid Tariff Concerns – TheMinerMag

- Compass Expands Bitcoin Mining Hosting with Soluna to 13 MW – TheMinerMag

- CleanSpark Becomes Second Bitcoin Miner to Report Reaching 50 EH/s Mark – TheMinerMag

Corporate News

- Riot Unloads Another 6.5M Bitfarms Shares, Cutting Stake to 13.4% – TheMinerMag

- Canaan discontinues AI chip business, which generated less than $1 million of revenue in 2024 – Link

- Bit Digital Raises $150M to Buy ETH, Quits Bitcoin Mining – TheMinerMag

Financial News

- Bit Digital Secures $44M Credit Facility from RBC for AI Data Center Expansion – TheMinerMag

- Hut 8 Doubles Bitcoin-Backed Credit Line with Coinbase to $130M – TheMinerMag