Bitcoin Hashprice Hits Record Low as BTC Falls Below $70,000

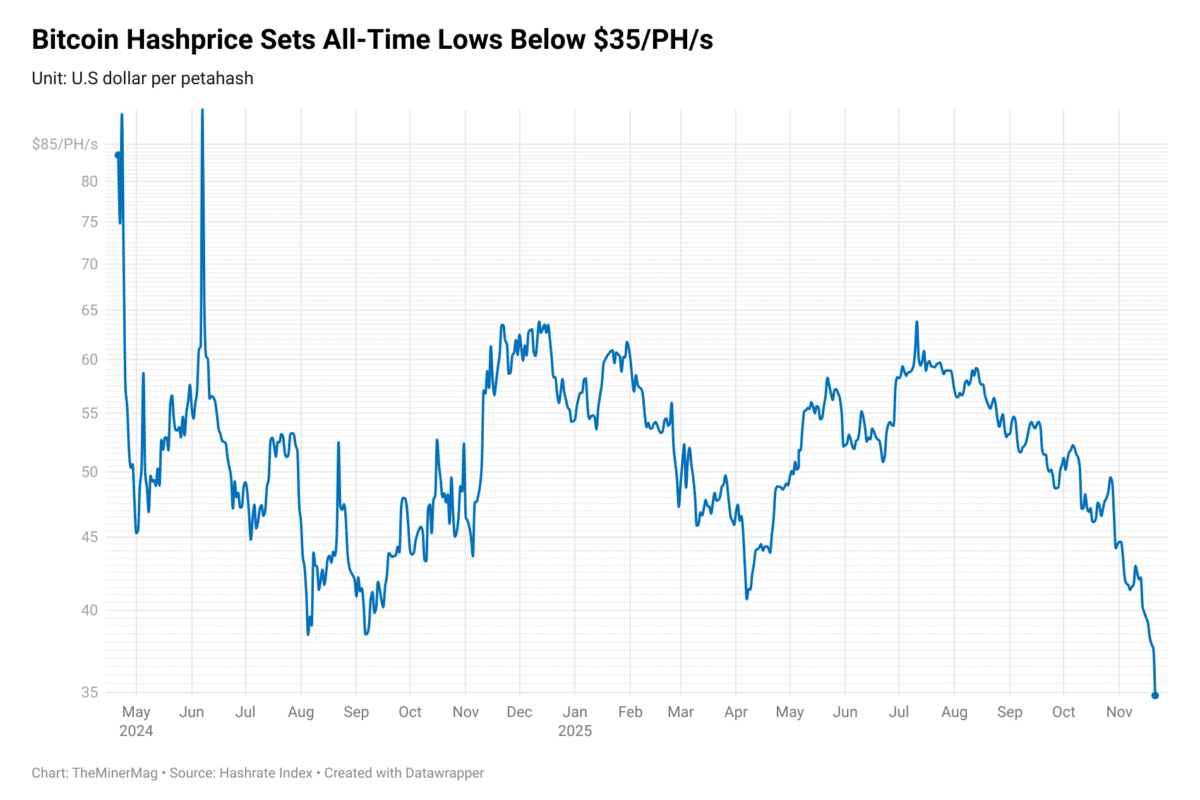

Bitcoin’s hashprice fell below $32/PH/s on Thursday, setting a new all-time low as the cryptocurrency’s price slid under $70,000 for the first time since November 2024.

The move erased all of bitcoin’s gains since former President Donald Trump’s reelection, marking a sharp reversal after months of elevated prices. Hashprice — a key profitability metric that reflects daily mining revenue per unit of hashrate — has come under sustained pressure from falling prices and still-elevated network difficulty.

Relief may be coming on the protocol side. Bitcoin’s mining difficulty is currently projected to decline by about 13.37% at its next adjustment, due in roughly two days. The expected drop follows a recent market downturn as well as the aftermath of a cold storm that temporarily forced a significant portion of U.S.-based mining capacity offline, dragging down network hashrate.

Even with the anticipated difficulty reset, miners remain under acute financial strain. Publicly traded bitcoin mining stocks closed Wednesday’s trading session with high single-digit to double-digit percentage losses, reflecting investor concern over deteriorating margins.

Shares continued to trend lower in pre-market trading on Thursday, suggesting further downside pressure as the sector digests weaker bitcoin prices and record-low hashprice levels.

The combination of lower prices, compressed revenues and volatile operating conditions underscores the fragile state of mining economics, particularly for operators with higher power costs or less efficient fleets, as the industry navigates one of its most challenging profitability environments to date.