Riot Stock Jumps 12% as AMD Deal Anchors Texas AI Data Center Expansion

Shares of Riot Platforms rose about 12% on Friday after the company announced a land acquisition and long-term leasing agreement that accelerates its push into AI and HPC data center development.

Riot said it has acquired 200 acres of land underlying its Rockdale site in Milam County, Texas, for $96 million, funding the purchase entirely through the sale of approximately 1,080 bitcoin from its balance sheet.

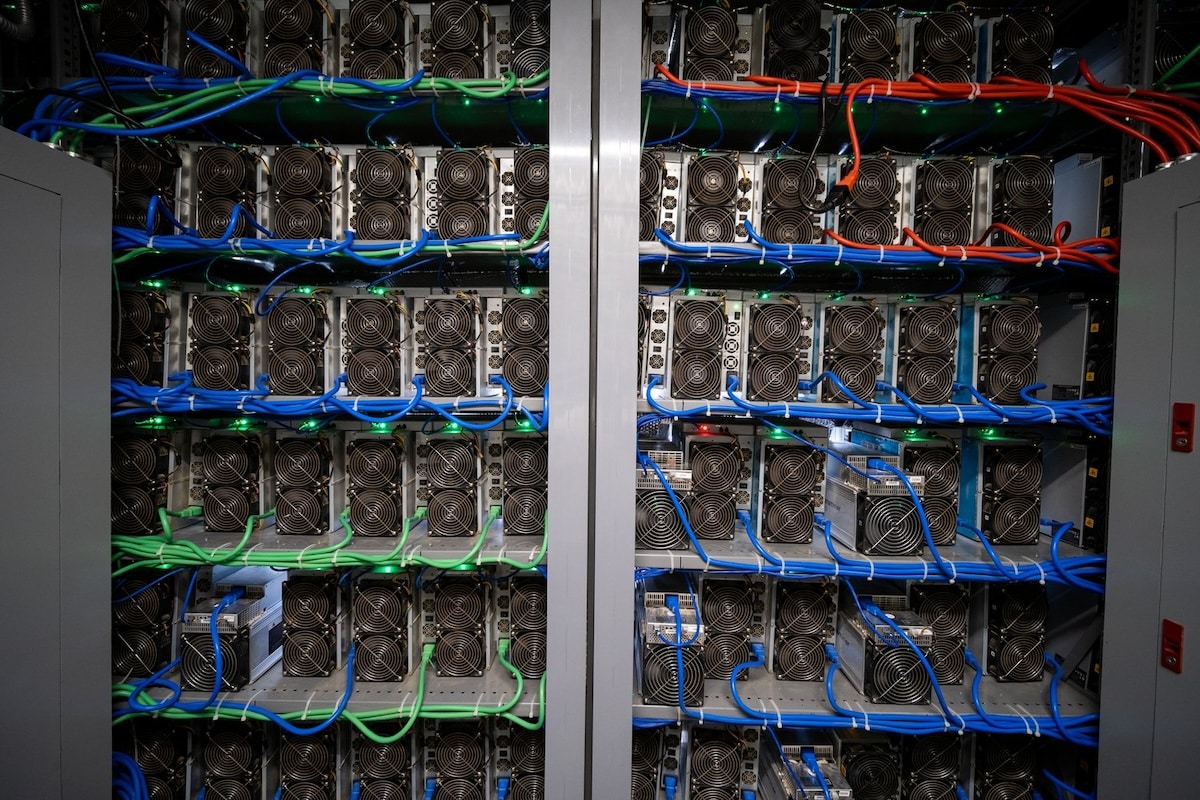

The transaction follows a sharp increase in Riot’s bitcoin sales late last year, as the company leaned more heavily on its balance sheet amid pressure on mining margins. Riot carried out its largest monthly liquidation to date in December, selling an estimated net 1,820 BTC after producing 460 BTC during the month.

The fee simple acquisition replaces a prior ground lease arrangement and gives Riot full ownership of the property, which the company said unlocks the site for large-scale data center development.

Alongside the land purchase, Riot disclosed that it has signed a data center lease and services agreement with Advanced Micro Devices, marking its first major hyperscale tenant at Rockdale. Under the agreement, Riot will deliver 25 megawatts (MW) of critical IT load capacity to AMD in phases starting in January 2026, with full delivery expected by May 2026. The initial lease term runs for 10 years and is expected to generate about $311 million in contract revenue, according to the company.

The agreement includes three five-year extension options that could lift total contract value to roughly $1 billion if fully exercised. AMD also holds an option to expand by an additional 75 MW and a right of first refusal on another 100 MW, which would bring its total potential footprint at the site to 200 MW.

Riot said the initial deployment will rely on retrofitting existing buildings at Rockdale, with expected capital expenditures of $89.8 million, or about $3.6 million per MW. The company estimates the lease will contribute an average of $25 million in net operating income per year.

The Rockdale site has a 700 MW grid interconnection, dedicated water supply and fiber connectivity. Riot said it intends to convert the full 700 MW of gross power capacity at the location for data center tenants over time.

With the Rockdale acquisition, Riot said it now owns and manages more than 1,100 acres and 1.7 gigawatts (GW) of fully approved power capacity across its two Texas sites, Rockdale and Corsicana, which are located roughly 100 miles apart. The company described the portfolio as positioned within the so-called Texas Triangle, encompassing the Austin, Dallas, Houston and San Antonio metro areas, a region that has become a focal point for U.S. data center growth.

Chief executive Jason Les said the AMD lease validates Riot’s infrastructure and development capabilities and represents a turning point in its strategy to repurpose bitcoin mining assets for AI and high-performance computing workloads. Riot formally began evaluating its sites for AI and HPC use less than a year ago.

The move comes as several publicly listed bitcoin miners seek to diversify revenue streams by leasing power and facilities to AI and cloud computing customers, amid pressure on mining economics from rising network difficulty. Riot said it plans to continue pursuing data center leasing opportunities at both Rockdale and Corsicana as it works to convert available power capacity to non-mining uses.