11 EH/s: Bitmain Eyes a New Bitcoin Mining Proxy? – Miner Weekly

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

While most attention in recent months has focused on publicly traded miners racing to add hashrate or pivot toward AI, one of the fastest-growing bitcoin mining operations has expanded largely outside the spotlight.

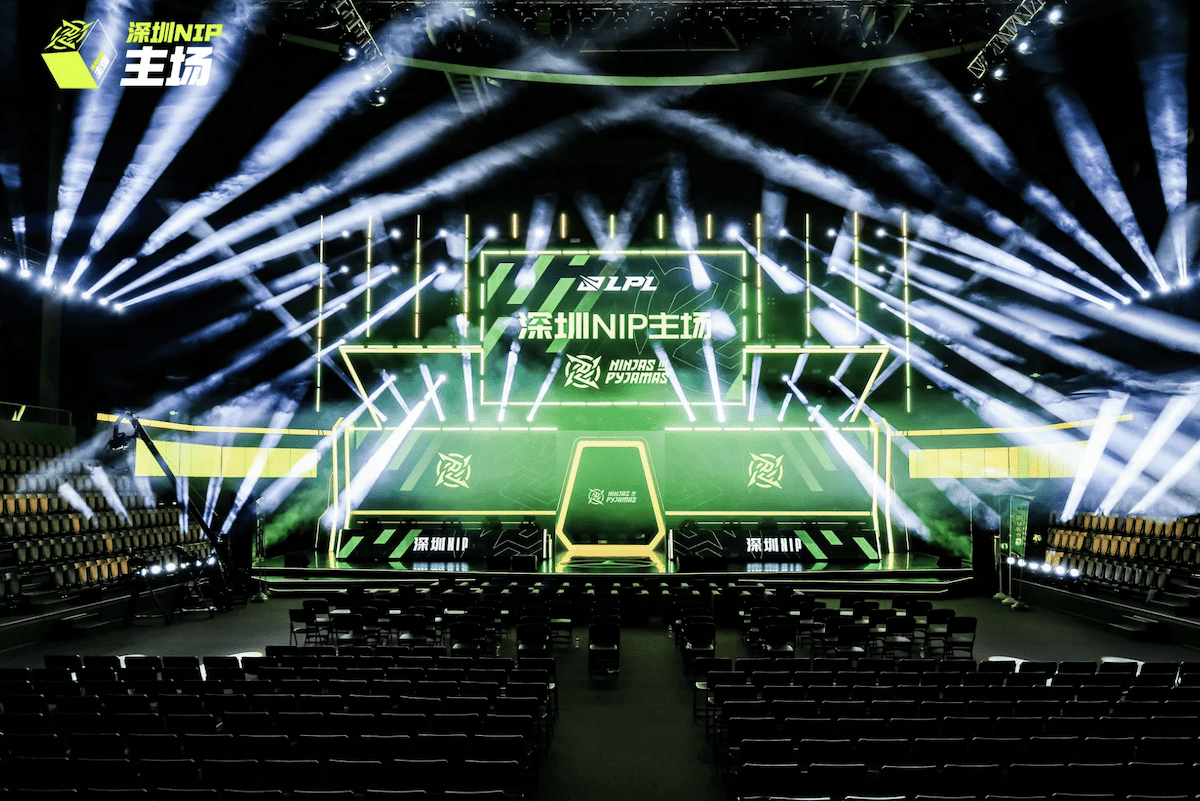

NIP Group (NASDAQ: NIPG), the $130 million parent company of esports brand Ninjas in Pyjamas, disclosed on Thursday that its bitcoin mining operations produced 151.4 BTC during an initial operating period from September through November 2025. At current prices, that output represents roughly $14.2 million in revenue.

The company also said its installed mining capacity has reached 9.66 EH/s following the partial closing of a previously announced transaction, with another 1.64 EH/s expected to come online later this month. Once fully deployed, NIPG expects total capacity of about 11.3 EH/s—placing it among the top 20 publicly traded bitcoin miners by disclosed hashrate and the largest by reported capacity in the Middle East and North Africa.

From esports to hashrate

NIPG’s move into bitcoin mining began in July, when the company announced it would acquire 3.11 EH/s of on-rack mining capacity from Fortune Peak and Apex Cyber Capital in exchange for newly issued Class A ordinary shares. The transaction closed in September, marking the launch of a dedicated digital computing division within the company.

In November, NIPG expanded the strategy significantly, agreeing to acquire an additional 8.19 EH/s of on-rack capacity from Apex Cyber Capital, Prosperity Oak Holdings and Noveau Jumpstar. That deal, also settled largely through equity issuance and convertible instruments, lifted the company’s stated long-term target to 11.3 EH/s and signaled that bitcoin mining had become a material second business line alongside gaming and entertainment.

Ownership links point back to Antalpha

What makes NIPG’s mining push particularly notable is not just its speed, but who is on the other side of the transactions.

Following the November expansion, Apex Cyber Capital held about 31.2% of NIPG, while Prosperity Oak Holdings controlled roughly 29.4%. Fortune Peak, the original seller of on-rack capacity, shares common ownership with Prosperity Oak through Chiu Chang-Wei.

Chiu is also a director at Antalpha, the financing and treasury arm of Bitmain. In parallel, Chiu has been heading Cango, which has emerged as one of the largest proprietary bitcoin miners following its own pivot into mining. Fortune Peak—the same entity that sold on-rack capacity to NIPG—previously sold mining capacity to Cango during its transformation into a large-scale prop miner. Additionally, Simon Ming Yeung Tang, the chief investment officer of Cango, was appointed to the board of NIPG after the July purchase.

Taken together, the transactions suggest a familiar structure: Bitmain-aligned entities transferring energized hashrate into publicly listed vehicles, financed through equity issuance rather than traditional capex-heavy self-builds.

A growing proprietary mining bloc

The scale of this activity is becoming difficult to ignore.

Cango has disclosed roughly 50 EH/s of mining capacity, while NIPG is approaching 11 EH/s, implying that known Bitmain-aligned proprietary mining operations now total more than 60 EH/s. That figure alone would make the “Bitmain camp” one of the largest bitcoin miners globally, even before accounting for undisclosed capacity or third-party arrangements.

The timing is also notable. In December, Bitdeer sharply increased realized hashrate through the deployment of its own SEALMINER machines, reinforcing a broader industry trend: the largest proprietary miners are increasingly those with access to proprietary hardware.

As public miners grapple with compressed hashprice, rising financing costs and shareholder dilution, vertically integrated players—whether through hardware ownership, financing arms or affiliated public shells—appear to be consolidating influence over a growing share of network hashrate.

Regulation News

- New York Weighs Data Center Energy Charges as AI Strains the Grid – TheMinerMag

Hardware and Infrastructure News

- Vistra, Meta Strike 20-Year Nuclear Power Deal Amid Rising AI Demand – TheMinerMag

- CleanSpark Land Deal in Texas Eyes 600 MW AI Data Center Build – TheMinerMag

- CoreWeave Deploys 16,000 GPUs at Delayed Texas Data Center for OpenAI – TheMinerMag

Corporate News

- Bitdeer Challenges MARA for Top Spot After December Bitcoin Production Jump – TheMinerMag

- Microsoft Vows to Pay Higher Power Rates to Shield Locals From AI Data Center Costs – TheMinerMag

- Bitfarms Announces Board Chair Transition in Anticipation of U.S. Redomiciliation – Link

- Applied Digital Appoints Co-Founder Jason Zhang as President – Link

- HIVE Expands into Paraguay, Launching One of the First Purpose-Built AI BUZZ Cloud Platforms – Link

Feature

- America’s Grip on Bitcoin Mining Slips, Despite Trump’s Ambitions for Dominance – Decrypt

- Texas Gets Tough on Data Center Power – Who’s Next? – Data Center Knowledge