Vistra, Meta Strike 20-Year Nuclear Power Deal Amid Rising AI Demand

Vistra has signed 20-year power purchase agreements with Meta to supply over 2.6 gigawatts of capacity, as big tech firms seek energy supplies to support rapid AI and data center expansion.

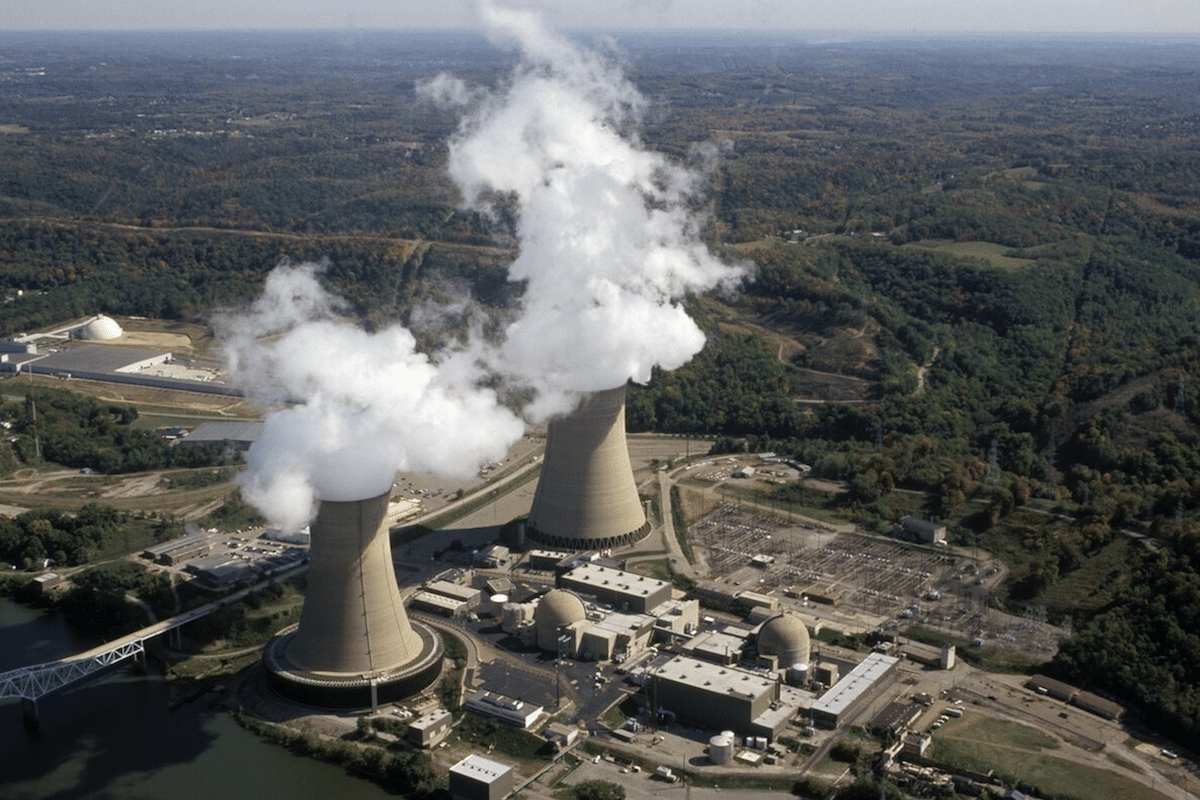

Vistra (NYSE: VST) noted in a filing on Friday that the PPAs cover a total of 2,609 megawatts of energy and capacity from its three nuclear facilities in the PJM market, including the Perry and Davis-Besse plants in Ohio and the Beaver Valley plant in Pennsylvania. The agreements include both existing output and future capacity tied to planned uprates at the sites.

Vistra expects to begin delivering a portion of the operating energy and capacity in late 2026, with full delivery by the end of 2027. Power associated with the uprates is expected to come online later, with initial deliveries beginning around 2031 and full delivery by the end of 2034.

The PPAs come as Meta continues to expand its artificial intelligence footprint. In recent weeks, the company has agreed to acquire Manus, a general AI agent application, underscoring Meta’s growing emphasis on compute-intensive workloads that require large volumes of reliable, around-the-clock power.

To support the uprates, Vistra plans to incur capital expenditures starting in 2026, with less than 20% of total spending projected to occur by the end of 2028. The company said the investments are expected to meet or exceed its publicly stated mid-teens levered return target.

At full delivery, Vistra estimates the PPAs will increase adjusted free cash flow before growth by approximately 8% to 10% from the operating portion of the contracts, with an additional 5% to 7% contribution from the uprate capacity. Meta said the deals would help finance expansions at the Ohio plants and extend the operating lives of the nuclear facilities.

The nuclear PPAs come as Vistra continues to expand its generation portfolio. The company recently completed the acquisition of Cogentrix Energy Power Management, significantly increasing its exposure to gas-fired and renewable assets, while positioning its nuclear fleet as a source of long-duration, carbon-free power for large technology customers.