Vistra to Add 5.5 GW of Gas Capacity in $4B Cogentrix Deal as AI Load Rises

Vistra Corp. has agreed to acquire 5.5 gigawatts of natural gas generation capacity in a $4 billion transaction as U.S. power demand rises alongside AI-driven data center growth.

According to a securities filing and a company announcement released Monday, a Vistra Corp subsidiary will acquire 100% of Q-Generation LLC, the parent company of Cogentrix, which is owned by funds managed by Quantum Capital Group.

The transaction values the portfolio at a net purchase price of about $4.0 billion, including cash, stock, and assumed debt, and is expected to close in mid-to-late 2026, subject to regulatory approvals.

Vistra said it will pay approximately $2.3 billion in cash and issue 5 million shares of its common stock, valued at $185 per share, to the seller. The company will also assume about $1.5 billion of existing indebtedness at Cogentrix, partially offset by an estimated $0.7 billion in expected tax benefits tied to the transaction. To fund the cash portion, Vistra has secured a commitment for up to $2.0 billion in senior secured bridge financing from Goldman Sachs Bank USA.

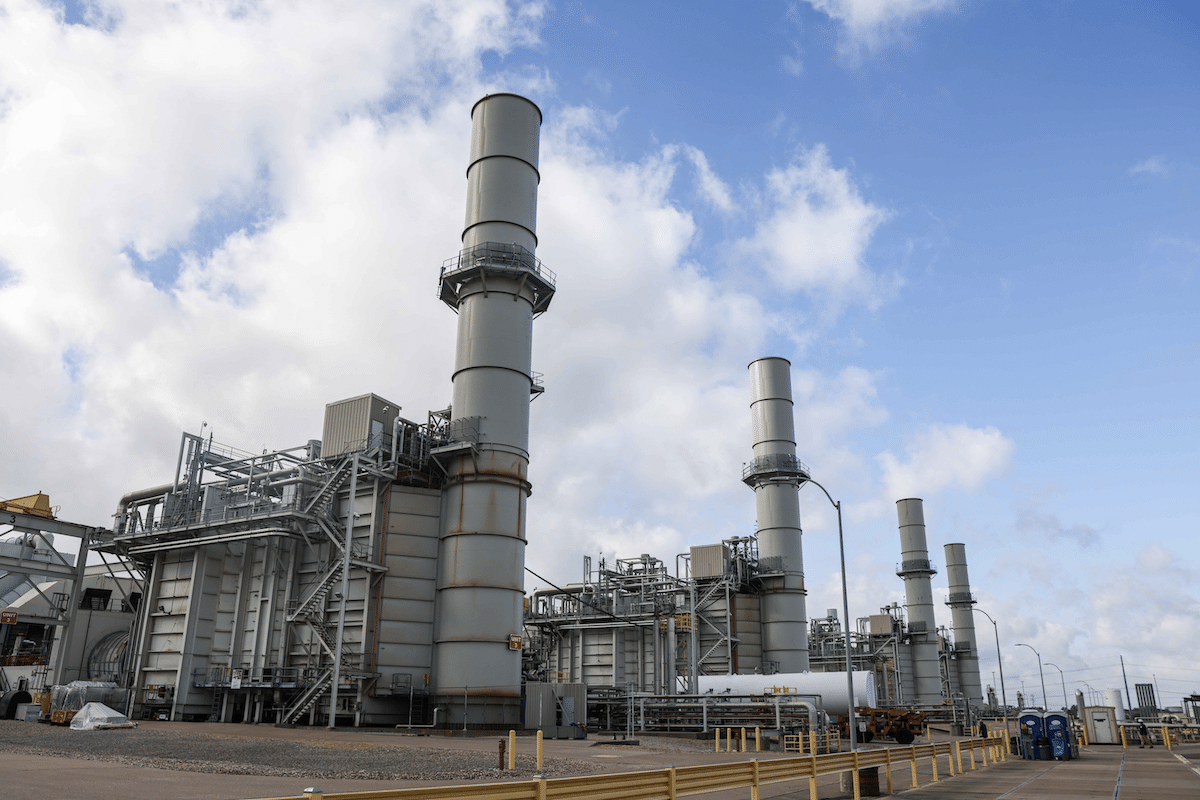

The Cogentrix portfolio consists of 10 modern natural gas facilities totaling 5,496 megawatts of capacity. The assets include combined-cycle and combustion turbine plants located in the PJM Interconnection market, ISO New England, and ERCOT. Several of the largest plants are in Pennsylvania, New Jersey and New England, with a cogeneration facility in Texas. Vistra will also acquire the remaining minority interests in two Pennsylvania plants it did not already fully own.

Based in Irving, Texas, Vistra is one of the largest competitive power producers in the United States, with a generation fleet of roughly 45 gigawatts spanning natural gas, nuclear, coal, solar and energy storage assets. The company has a market capitalization of roughly $60 billion and operates across multiple deregulated power markets, while also owning a large retail electricity business serving residential and commercial customers.

Cogentrix, by contrast, is a privately held power generation platform focused primarily on natural gas assets. Prior to the sale, it was owned by Quantum Capital Group, a Houston-based private equity firm with a long history of investments across energy infrastructure and power generation.

Vistra said the acquisition implies a valuation of about $730 per kilowatt of capacity and roughly 7.25 times expected 2027 adjusted EBITDA from the Cogentrix assets. The company expects the transaction to be accretive to cash flow per share beginning in 2027 and reiterated its commitment to capital returns through dividends and share repurchases, alongside a long-term net leverage target below three times.

The deal comes as expectations for U.S. electricity demand are being revised upward. In its latest Short-Term Energy Outlook, the U.S. Energy Information Administration forecasts that total U.S. power consumption will reach a record 4,327 billion kilowatt-hours in 2026, representing year-over-year growth of about 1.7%. The agency noted that the increase follows nearly two decades of relatively flat demand.

According to the EIA, the projected growth is being driven by the rapid expansion of data centers supporting artificial intelligence and cloud computing, rising electrification from electric vehicles and heat pumps, and the onshoring of energy-intensive manufacturing such as semiconductor and battery plants. Many of those large new loads are concentrated in competitive power markets like PJM, ISO New England and ERCOT, where the Cogentrix assets are located.