Miner Weekly: Bitcoin Mining Leaderboard Shakes up Ahead of Q3 Earnings

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

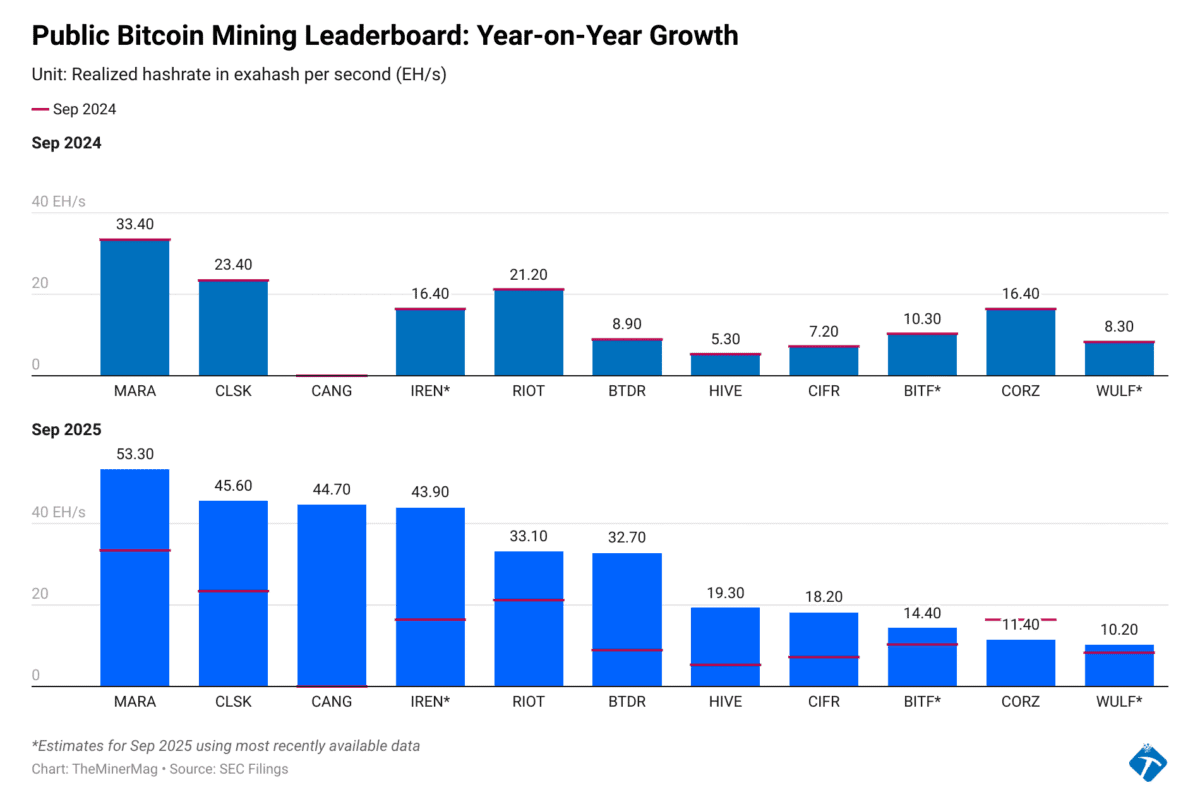

As public miners gear up to report third-quarter results, the latest data from September reveals a major reshuffling of Bitcoin’s mining leaderboard year-over-year. Once dominated by a few clear front-runners, the rankings now show a new wave of mid-tier operators closing in fast after a year of aggressive expansion.

Cipher Mining, Bitdeer, and HIVE Digital have all surged into the upper ranks of realized hashrate, narrowing the gap with long-established leaders like MARA, CleanSpark and Bitmain’s proxy Cango. Their ascent highlights how the middle tier of public miners—once trailing far behind—has rapidly scaled production since the 2024 halving.

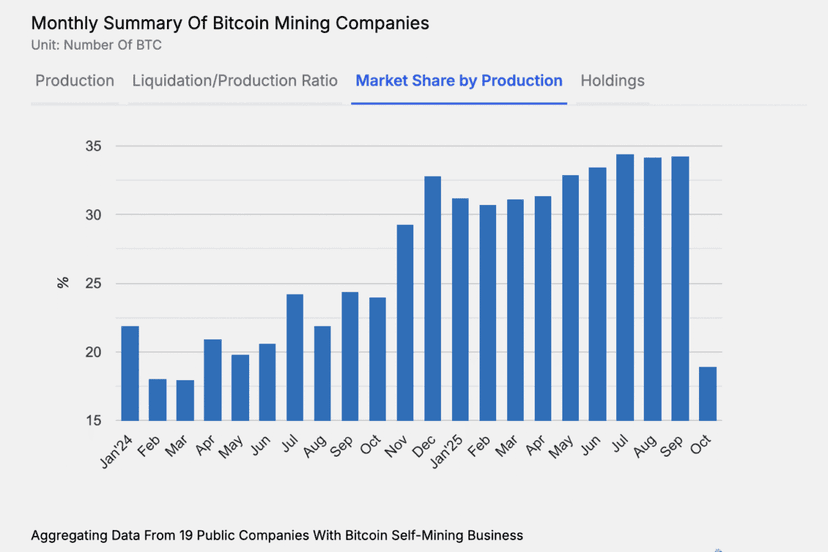

Collectively, the top public miners reached 326 EH/s of realized hashrate in September 2025, up from 150 EH/s a year earlier. That represents about 31.6% of Bitcoin’s network total, compared with 22% last September—evidence of both rapid growth and deeper consolidation among listed miners heading into earnings season.

MARA, CleanSpark (CLSK), and Cango (CANG) held their positions as the three largest public miners with realized hashrates of 53.3 EH/s, 45.6 EH/s, and 44.7 EH/s, respectively. But several mid-tier names in 2024 closed the distance: IREN made it to the tier-1 league with a 167% growth, Cipher Mining (CIFR) jumped 152% to 18.2 EH/s, Bitdeer (BTDR) rose by 267% to 32.7 EH/s after energizing new SEALMINER deployments, and HIVE nearly quadrupled its hashrate from 5.3 EH/s to 19.3 EH/s over the past year, propelled by new hydro-powered sites in Paraguay.

These gains have redrawn the competitive map, displacing some early leaders and signaling that mining scale is becoming increasingly distributed among publicly traded operators.

While MARA and CleanSpark continued their expansion from 2024 levels, Riot (RIOT) grew more modestly—from 21.2 EH/s to 33.1 EH/s—and slipped in ranking amid faster growth elsewhere. Core Scientific (CORZ), once the largest bitcoin mining operation in 2021, saw realized hashrate fall from 16.4 EH/s to 11.4 EH/s as it shifted resources toward AI and HPC hosting partnerships.

The top public miners now control nearly one-third of global hashrate, up almost ten percentage points year-over-year. That shift underscores how capital access, hardware upgrades, and energy diversification have enabled listed miners to expand faster than private peers—even in a post-halving environment marked by lower margins.

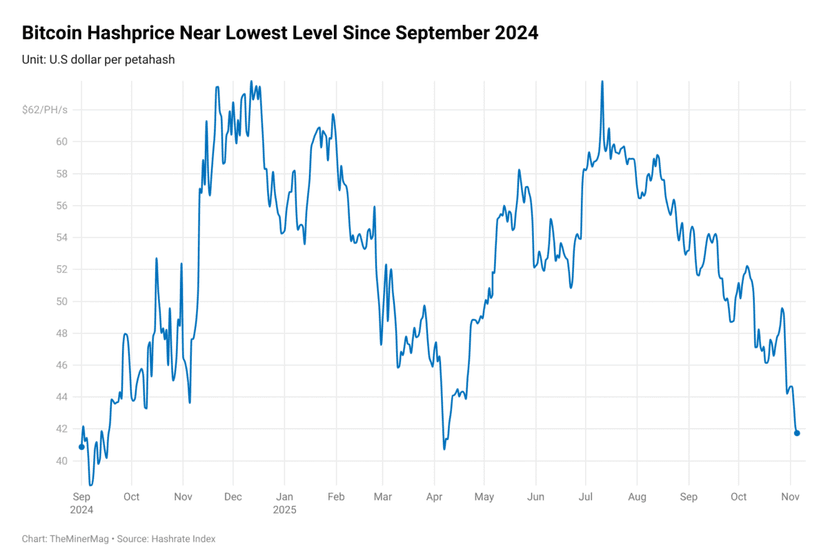

As earnings season approaches, these reshuffled rankings set the stage for a closer look at which miners have managed to translate their rapid expansion into stronger financial performance, and which are still racing to catch up on efficiency and profitability.

Regulation News

- British Columbia seeks permanent ban on new crypto mining projects – The Block

Hardware and Infrastructure News

- HIVE Raises 2026 Target to 35 EH/s with Paraguay Bitcoin Mining Expansion – TheMinerMag

Corporate News

- Crypto Miners Riding the AI Wave Are Leaving Bitcoin Behind – Bloomberg

- Argo to Delist from London Stock Exchange Amid Debt Restructuring – TheMinerMag

- CleanSpark joins bitcoin-to-AI pivot with hire of Humain exec to lead data-center expansion – The Block

Financial News

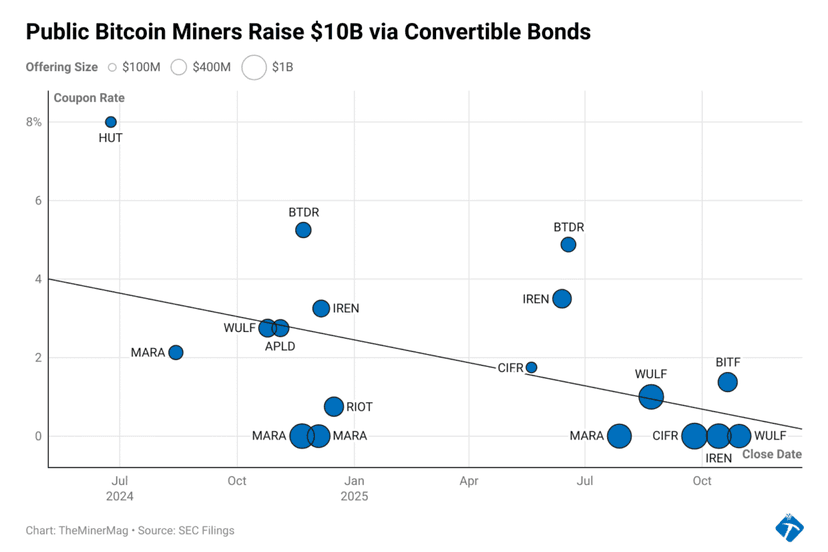

- Bitfarms Announces Closing of US$500 Million of Convertible Senior Notes – Link

- TeraWulf Prices Record $3.2B Bond Deal at 7.75%, Betting Big on AI Pivot – TheMinerMag

- CoreWeave CEO Stands Firm on $9B Core Scientific Offer as Shareholder Opposition Mounts – CoinDesk

AI/HPC News

- Goldman Sachs Pursues Bigger Share of AI Infrastructure Financing Boom – WSJ

- Applied Digital Announces $5 Billion AI Factory Lease at Polaris Forge 2 ND Campus – Link

- Nscale founding director exits AI infrastructure provider in wake of $1.1bn investment round – Computer Weekly