CoreWeave to Acquire Core Scientific in All-Stock Deal to Expand AI Infrastructure

AI cloud computing firm CoreWeave has agreed to acquire Bitcoin mining and data center operator Core Scientific in an all-stock deal valued at approximately $9 billion.

CoreWeave announced the transaction on Monday, which marks a major step in its vertical integration strategy as it seeks to secure control over critical infrastructure for artificial intelligence and high-performance computing (HPC) workloads.

Under the terms of the agreement, Core Scientific shareholders will receive 0.1235 shares of CoreWeave Class A stock for each share they own. The exchange ratio implies a per-share valuation of $20.40 based on CoreWeave’s July 3 closing price, representing a 66% premium to Core Scientific’s last unaffected share price on June 25.

Core Scientific shareholders will own less than 10% of the combined company upon closing, which is expected in the fourth quarter of 2025 pending regulatory and shareholder approvals.

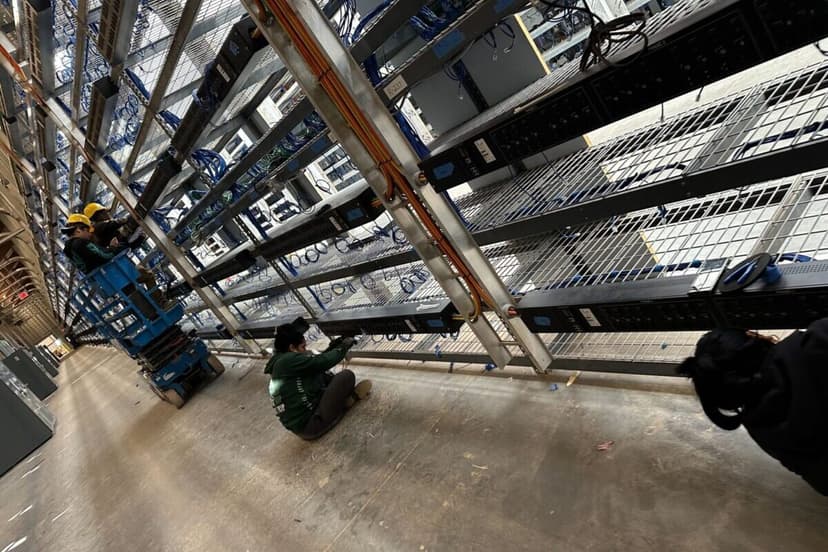

CoreWeave said the acquisition will expand its power footprint to 1.3 gigawatts (GW) across Core Scientific’s nationwide data center portfolio, with more than 1 GW of potential capacity available for future expansion. The move allows CoreWeave to bring key infrastructure assets in-house, streamlining operations and reducing its dependence on leased facilities.

“This acquisition accelerates our strategy to deploy AI and HPC workloads at scale,” said CoreWeave CEO Michael Intrator. “Owning this foundational layer of our platform will enhance our performance and expertise as we continue helping customers unleash AI’s full potential.”

Core Scientific, which emerged from bankruptcy earlier this year and has been shifting away from Bitcoin mining toward broader data center services, called the merger a natural evolution of its longstanding relationship with CoreWeave. The two companies have previously collaborated on hosting agreements.

Core Scientific has not commented on further plans with its existing bitcoin mining fleet, which mined 187 BTC with a realized hashrate capacity of 12.35 EH/s.

CoreWeave expects the deal to generate roughly $500 million in annual cost savings by the end of 2027, including the immediate elimination of over $10 billion in lease liabilities for Core Scientific’s existing sites. The company also signaled it may repurpose some of Core Scientific’s infrastructure toward HPC or exit the crypto mining business altogether over the medium term.

The transaction is structured to be leverage-neutral and is expected to provide CoreWeave with greater financing flexibility, including access to infrastructure-specific funding channels at lower costs.

Core Scientific’s shares plunged by 16% during pre-market trading hours on Monday.