Mining Stocks Outperform Bitcoin But Trail Yearly Peaks

Bitcoin mining stocks have exhibited strong growth over the past month, surpassing Bitcoin’s 10% gains, yet they remain considerably below their yearly highs.

Recent data indicates that 10 out of the 14 most actively traded mining stocks have experienced increases exceeding 20% over the past four weeks. Notably, Cipher achieved the highest return of 65%, followed by CleanSpark and Riot.

The rebound in mining stocks coincides with renewed optimism in the Bitcoin market ahead of the U.S. election. This has propelled Bitcoin close to $69,000 and boosted mining profitability back to the critical $50/PH/s threshold.

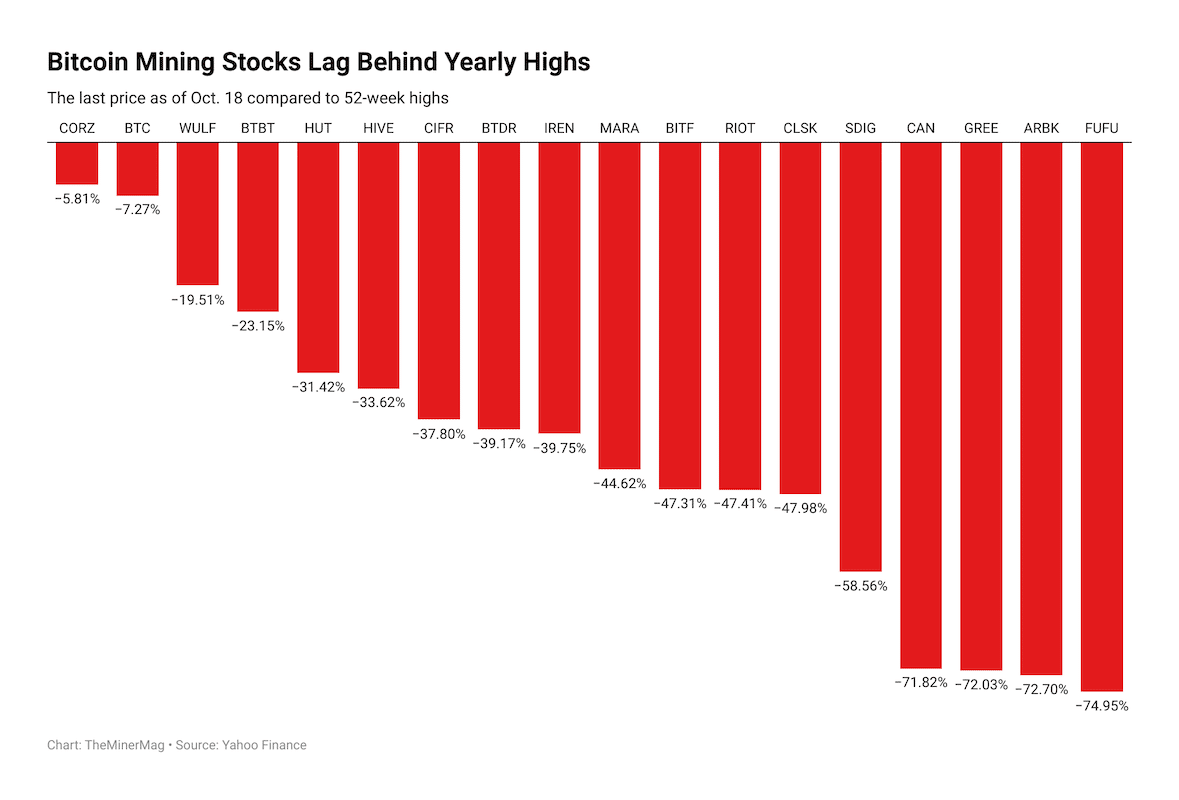

As of this publication, Bitcoin is trading at $68,400, approximately 7% below its all-time high of around $73,500. In contrast, nearly all major mining stocks remain significantly below their 52-week highs documented earlier this year, with the exception of Core Scientific.

Year-to-date, Bitcoin has risen by 55%, outperforming most mining stocks, which are typically regarded as leveraged plays on Bitcoin. Only Core Scientific and Terawulf have recorded higher returns than Bitcoin so far this year.